Best Budget Apps 2025: Top Tools for Personal Finance

June 2, 2025

Find the Best Budget App for Smarter Money Management in 2025

Managing money today means more than just checking your bank balance once a week. With rising costs, unexpected expenses and the push to save more, people are turning to their phones for help. That’s where the best budget app comes in. These tools are not just digital notebooks. They help you set goals, track expenses, plan ahead and feel more in control of your spending. For many, the right app turns financial stress into simple, daily habits.

The variety of budgeting apps available in 2025 is bigger than ever. Some apps focus on giving you detailed charts and insights. Others are designed to be friendly for beginners. A few are built for couples or families, while some target freelancers juggling business and personal expenses. Whether you need a money management app for your weekly grocery trips or a full system for managing bills, subscriptions and savings, there’s something out there that fits how you live.

Choosing the right app can make a big difference in how successful you are with your money. A good personal finance tool works in the background of your life. It reminds you when bills are due, helps you stick to your budget and gives you a better picture of where your money goes. If you’re trying to save money, reduce spending or just understand your habits better, a smart budget tracker can be more useful than any spreadsheet or notebook.

This guide brings together the top picks for 2025, focusing on different needs, lifestyles and financial goals. Whether you’re just starting out with budgeting for beginners or looking for advanced financial planning apps, this list covers it all. You’ll find tools that work on your phone, sync with your bank and give you insights you can actually use. If you want a real solution, not just another app to ignore, keep reading. These are the mobile budgeting tools people are using and recommending right now.

Comprehensive Budgeting Solutions

Some people want more than just a simple tracker. They need a complete view of their money. A comprehensive budgeting app gives that control. It covers all parts of your finances in one place.

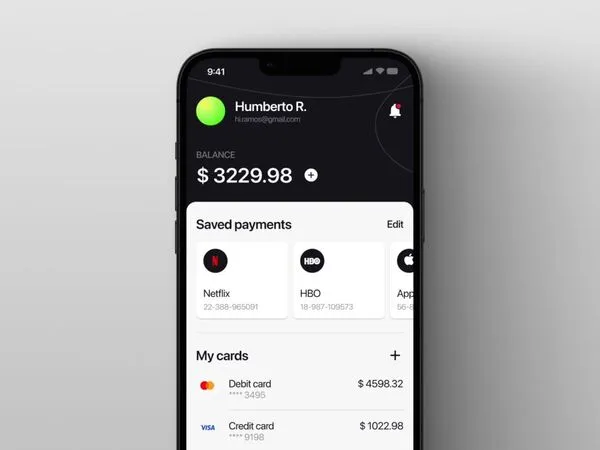

These apps work as an all-in-one finance tool. You can see income, bills, savings and even investments together. Everything is in one clear layout. It helps users manage money without switching between different platforms.

Most tools in this category offer a custom budget dashboard. It shows where you spend most, where you can cut back and how much you save each month. Many also let you set targets through financial goal setting features. Whether it's paying off debt or planning a vacation, goals keep you focused.

This type of app is great for anyone thinking beyond weekly spending. If you care about long-term money planning, you’ll benefit from deeper data. These tools use budget analytics to give insights and help you track spending with purpose.

Budgeting Apps for Beginners

If you’re new to money management, the first step is choosing the right tool. Many apps are made just for people who want to learn how to save and plan without stress. These tools are great for budgeting for beginners. They focus on ease, clarity and daily habits that help you grow.

The best part is that you don’t need to know much to start. With the right beginner budget app, you can learn while using it. Most are designed to teach you as you go. They include simple money tools like daily alerts and weekly summaries. If you want to learn how to budget in a way that makes sense, these options are perfect.

PocketGuard

PocketGuard is simple and smart. It shows you what’s safe to spend after your bills and goals are set. It breaks things into clear parts. This makes it easy to follow. You can plan without needing a finance degree.

Simplifi by Quicken

Simplifi helps you create a clear money plan. It gives you a full view of your spending. You can set limits and track them in real time. It also shows patterns, which helps you understand your habits. This is great for someone who wants a clean personal budget planner.

Goodbudget

Goodbudget uses a digital envelope system. You set categories for your spending and stick to the plan. This helps you stay focused on limits. It’s simple but teaches good habits early. It’s perfect for people learning to plan monthly expenses.

Envelope Budgeting Systems

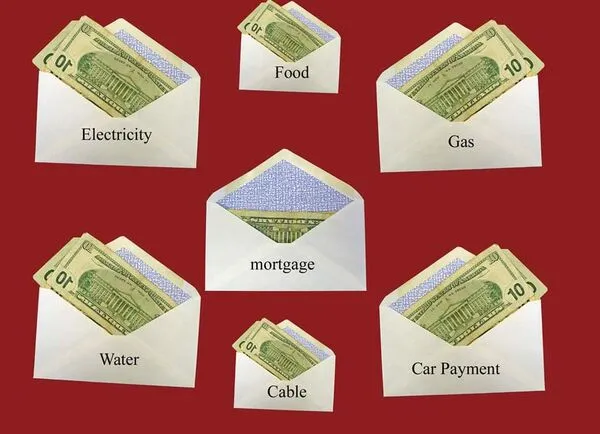

Envelope budgeting divides your money into clear spending groups. You plan how much to use for each category. Once the money is gone in that group, you stop spending. It builds discipline and helps control habits. This method is useful if you want to follow a clear monthly plan.

Digital tools now offer the same method on your phone. These apps give you digital envelopes instead of paper ones. You can set rules, track your progress and make changes easily. Envelope budgeting works well for people who like knowing exactly where their money goes. It brings structure to your spending.

This style helps manage fixed income and avoid overspending. You always know how much is left in each group. You can adjust when needed but still follow your limits. These tools support budgeting with categories, simple setup and hands-on tracking.

Budget Envelope

Budget Envelope keeps things simple. It lets you create envelopes for things like food, rent and fun. You can see what you have left in each one. The app uses a cash-style system. You track spending by entering each item yourself. It’s great for those who like manual expense tracking and want a real sense of control. It brings the old envelope idea into the digital world.

Budgeting Apps for Couples

Money can be a sensitive topic in relationships. That’s why the right tool helps both partners feel involved. Budgeting apps for couples let two people plan together. You can track goals, expenses and savings in one place. This makes money talks easier.

These apps are made for teamwork. They show how much each person spends. You can set shared limits. You can also build goals as a team. This builds trust and helps avoid surprises. It’s a simple way to grow good habits together.

Using a shared budget app can stop small issues from turning into big ones. You both see where the money goes. You can plan trips, pay bills and save faster. The key is clear tracking and open access. These tools are great for long-term planning.

Honeydue

Honeydue is made just for couples. You can link accounts or enter spending manually. It shows your total picture and breaks down who spent what. The app also sends reminders for bills. It’s a great couples finance tracker for everyday use.

Budgeting Apps for Students

Students often deal with tight budgets. Rent, books and food can eat up income fast. That’s why budgeting for students needs to be simple and clear. The right app makes things easier without adding stress.

These apps help you see where your money goes. You can track meals, school costs and fun spending. Some even help you plan for student loans. A good student budget app shows what you have and what you need. It teaches smart habits early.

Apps for students focus on speed and ease. They do not require a lot of setup. Many work with part-time jobs or student aid. You can check your balance and plan each week. A good tool helps you track school expenses in real time.

Mint

Mint is easy to use and free. It links to your accounts and shows spending in categories. You can set limits and alerts. It helps with college money management in a way that makes sense. If you want to manage student money better, Mint is a solid choice.

Wally

Wally lets you track spending manually. It works well for students who prefer to stay hands-on. You can set goals and monitor progress. The app is clean and simple. It’s a great pick for anyone using a college money app for the first time.

Budget Smarter, Not Harder: Your Next Step Starts Here

Budgeting today is not what it used to be. You no longer need a notebook or a spreadsheet to take control of your money. With so many personal finance tools available, you can find the best budget app that fits your daily life. Whether you need something for joint planning, student expenses or freelance income, there’s an option out there that works just for you.

What matters most is choosing an app that matches your goals. Some focus on simplicity. Others offer full dashboards with charts and planning tools. Some use automation. Others give you control through manual entry. The key is to start. When you begin to use money tracking apps, you start to see patterns. That leads to better choices and stronger results.

Good budgeting is more than numbers. It’s about understanding how and why you spend. A reliable budget planner helps you stay on track and build habits that last. You can create budget categories, monitor your income and learn to save money without guesswork. These tools are built to guide you step by step.

No matter where you are in your financial journey, the right app gives you a push in the right direction. With today’s expense tracker features and smart mobile finance tools, anyone can build strong budgeting habits. You don’t have to be perfect. You just have to be consistent. Choose an app that makes that easy, and you’re already on your way.